The Low Down on Interest Rates and Financial Pyramids

Find out the biggest innovations that are setting crypto up to displace the most ingrained TradFi systems

Interest rates play a crucial role in markets as they determine the cost of money over time. This, in turn, acts as the essential benchmark against, which all other financial assets are priced. Yet rates are inherently difficult to grasp given the differences between the absolute level of rates (nominal rate), as well as the inflation-corrected rates (real rate), along with the differences in rates across the maturity spectrum (the curve). Of course, this is all without even taking into consideration, the contrasts between varying markets and instruments. In this article, we will provide a comprehensive breakdown of everything you need to know about interest rates while comparing traditional markets with their crypto equivalents.

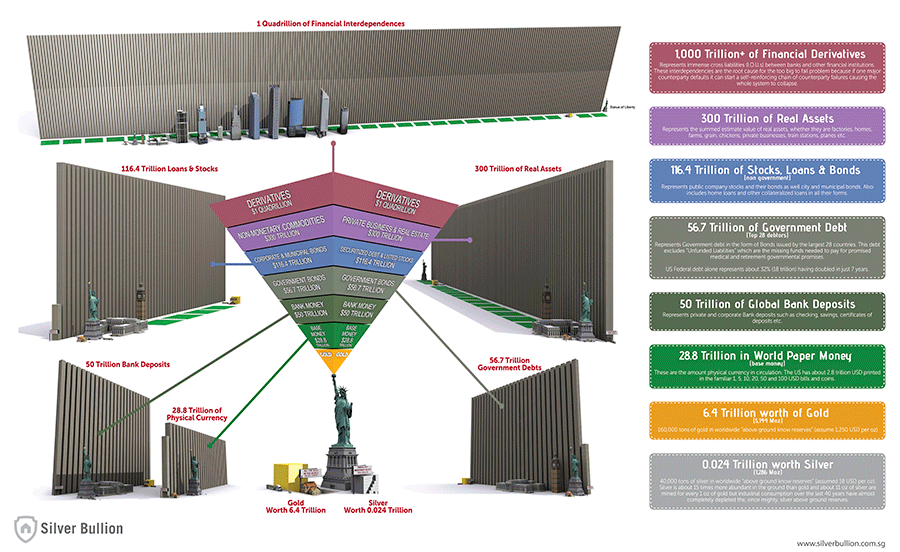

To put it all into perspective, let's start with Exter's pyramid. John Exter was an Advisor to Paul Volcker during his time at the Federal Reserve, where he developed a theory on the liquidity and value of market investments, in conjunction with how much risk they carry (see diagram below courtesy of Silver Bullion).

Although the numbers are in constant flux, it is the relative scale of things that we shall bring to focus. At the bottom of the pyramid, we can deduce that all the precious metals in the world including gold and silver, amount to less than 10 trillion USD. The next layer deals with money in circulation such as notes/coins/bank deposits, which account for 80-odd trillion USD, or around 10x the amount of precious metals. Government debt and other financial securities, such as stocks/loans/bonds come in at just under 200 trillion USD, so let's say roughly 20x the value of precious metals. Then there are still private assets like real estate/private enterprise, which could be estimated to be worth 30x, while the global derivatives market would come in at about 100x the value of precious metals.

By looking at this picture, one can quickly grasp why we let go of the gold standard, as the reserve ratio at current values would be less than 1%. As such, we obviously needed an alternative manner of tethering the system, which is exactly the role that interest rates play.

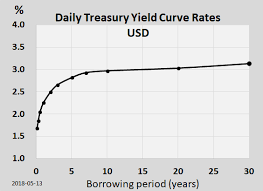

The further away from the tip of the pyramid one goes, the higher the risk of the financial instrument is deemed, and therefore the yield for holding such an asset is expected to be greater. Gold has no risk as it is a bearer instrument; it pays no interest or dividend. Bank deposits, on the other hand, bear some counter-party risk and thus require interest to compensate depositors, especially in the case of longer-dated term deposits. Furthermore, bank deposits and other financial instrument rates are generally priced on the government bond yield curve (nominal rate), which plot the yields of government bonds according to their maturity levels. Graph-wise, a normal yield curve is upward-sloping, meaning that longer-term bonds have higher yields than shorter-term bonds.

Of course, this figure is a representation of "normal" times, since unfortunately we currently have an "inverted" yield curve, where short-term rates are higher than longer-term ones. Historically this does not happen very often and is usually a sign that the central bank is trying to slow down the economy and/or inflation, by keeping short-term rates high while the market outlook is expecting slower growth or a recession.

Most of the curve is "normally" set by markets transparently pricing bonds of various maturity. The front end of the curve is "normally" set by the central bank of a country, who determine the overnight rate at, which banks can borrow or lend their reserves to/from the central bank. As banks are major players in government bond markets, these rates influence the level that the banks are willing to hold or buy government bonds. Then from the bank's perspective, it in turn acts as the base rate against, which they are willing to provide credit to borrowers.

The longer end of the curve is more speculative since it is a reflection of the market's longer-term outlook on economic growth and inflation. This also presents a kind of paradox, because inflation can only be truly determined with hindsight, by using comparisons from historical data. Getting an accurate forecast is incredibly hard in particular if popular benchmarks, like inflation-protected debt instruments, or SWAP and futures curves are heavily influenced by central bank policies.

It is important that we also cover one more aspect of the debt markets, which is spread.

Debt instruments other than government bonds come in various forms. We have already discussed the maturity and term structure of the government bond curve, most non governmnet debt instruments basically all trade at higher yields, with their difference being called the spread. The spread on debt instruments compensates the holder/lender for actual credit and counter-party risk, which is deemed higher for companies than governments, for the most part.

Spreads are not static and are normally inversely correlated to the credit quality of the borrower. For example; a BBB-rated credit borrows at wider spreads than a higher-quality AAA-rated company. However, they also reflect the state and liquidity of the debt markets, where tight spreads are an indication of ample liquidity and appetite for lending & borrowing, while wider spreads indicate stresses in the debt markets.

Now back to the pyramid. In the absence of any gold backing, the entire pyramid is tethered to the government bond curve, either directly through a spread (fixed income instruments), or indirectly through the discount rate of future earnings/cash flows (equity & derivative instruments). Thus this ability to influence "the curve", holds a great responsibility, and was historically deemed too large for a mere mortal to bear. In turn, this brought favor to tethering the value to precious/scarce physical commodities instead of relative valuation through an arbitrary curve. However, since the abandonment of the gold standard, the ability to influence the curve past short-term rates has been taken to new heights.

There have been novel strategies conceived, such as quantitative easing and other mostly inflationary measures, that allow central banks to influence market-based pricing of bonds and other credit instruments across the maturity spectrum. These policies have led to the testing of the boundaries of the current system, where tethering occurs only through relative rate differentials. Causing debt-to-GDP levels to exceed any ability to ever repay such debts, without either inflationary measures and/or financial repression (capping yields on government bonds). All in all, it has pulled into question the sustainability of a system that is entirely built on credit and the growth thereof.

Enter Crypto

The crypto industry could be described in short, as dealing with cryptographically secured digital assets, on a blockchain with monetary policies and other smart contract features that can be set in code. Bitcoin is often called digital gold, and it is clear that Bitcoin as an asset would be a superior reserve, to which a new system could be tethered. The question remains however whether the Bitcoin network could function as the base settlement layer for all of the remainder of Exter's pyramid. More importantly, it raises another issue on whether the rest of the pyramid would indeed survive a return to a non-inflationary fixed reserve standard.

One of the main competitive advantages that digital assets have over the traditional financial realm, is their capability of coding monetary policy into the foundations, via smart contract-enabled blockchain layers. Therefore, incorporating blockchain technology could serve to improve the existing system, or indeed rework it entirely. Replacing third-party intermediaries with verifiable blockchains & smart contracts with 100% transparency.

The Digital Asset Ecosystem (DAE)

At this point in the experiment, we have created the tokens (digital assets that can be self-custodied at a minimal cost) and we have multiple blockchains, which are essentially a hybrid between a payment network and ledger of record for said tokens. These different blockchains are in effect all competing to optimize the trilemma relating to scale, speed & security and although the progress on these measures is immense there is still some way to go before the system as a whole can credibly replace all of TradFi. That said, there are many smart contract-enabled applications and protocols, that have been battle-tested in a largely leveraged trading focussed environment that are ready for mainstream adoption/use. At Florence Finance we believe the next phase in crypto adoption will be about connecting existing app & protocol "crypto building blocks" to the real economy. The integration of Real World Assets (RWA) with DeFi will drive adoption through real-world use cases and slowly start to balance out the speculative focus that crypto has had to date.

In terms of debt instruments and markets, there are obviously no central banks in crypto, that set the rates. The system has been created accordingly, so as to avoid the endless rehypothecation, which is the process of using the collateral of an already existing loan as collateral for another loan. This means that age-old fractional reserve practices with the heavy-handed regulatory oversight required to keep them "safe" are being phased out, while new more transparent, and inherently stable systems are being built starting with a clean slate.

But it's not all puppy dogs and daisies, there is inflation within the DAE as well I hear you say... In the form of mining rewards and other inflationary incentives of various tokens & blockchains. That is correct, the point of emphasis, however, is that such mechanisms are set in code upfront & transparently for all to see, and thus not subject to the whims of human intervention, other than as agreed up-front in code.

Today the entirety of the DAE has a market cap of less than 1 trillion USD.

This is still less than 1/10th of the value of all the gold in the world and less than 0.5% of the assets, that comprise our traditional financial system, which excludes private assets & derivatives. In order for the DAE to grow, it will need to replace the current practices we see in TradFi with a better, smarter, more efficient, and more transparent alternative.

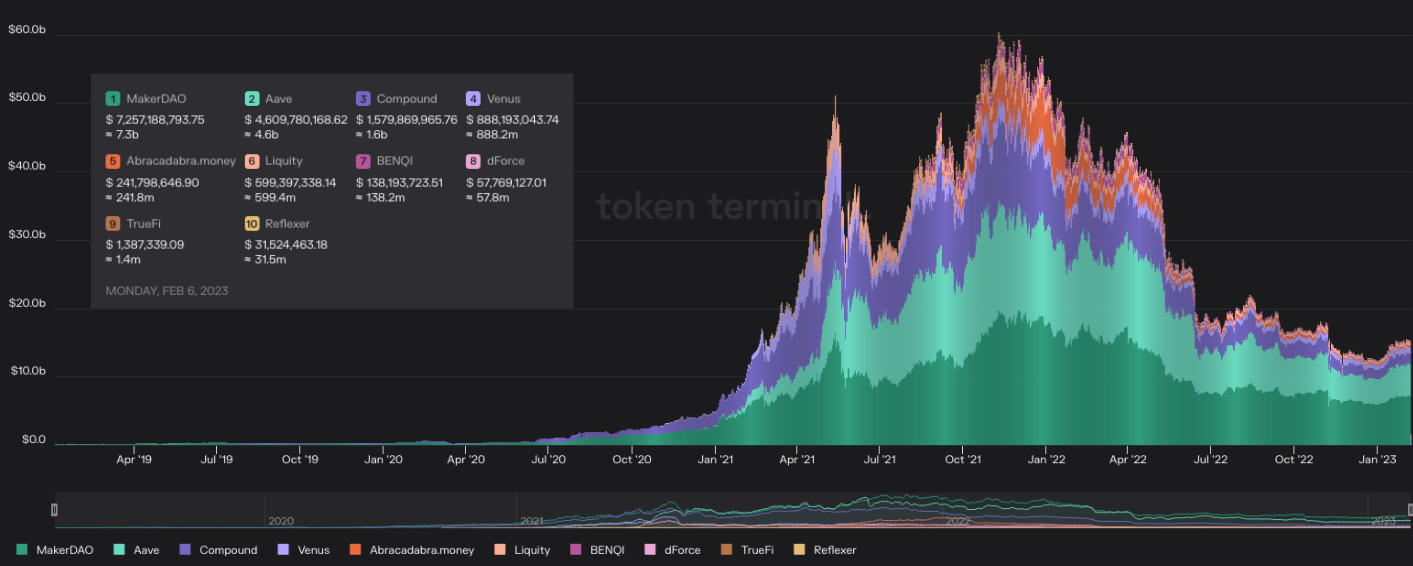

Lending protocols are but a small subset of the DAE, yet the chart below shows the TVL (Total Value Locked) of the larger protocols since inception.

Pure on-chain lending was pioneered by protocols such as Maker, Compound, and Aave. They allowed users to lock up their digital assets in smart contracts, and borrow against this collateral, which acted as an over-collateralized loan. Lenders could rest assured that they would receive their principal back, through smart contract-embedded automatic liquidation of collateral, if preset levels of said over-collateralization were breached.

Although there is always some smart contract risk, such lending activity actually poses very little, if any credit risk. Herein lies also part of the problem of over-collateralized lending, namely that it can never generate more leverage than the value of the collateral. At Florence Finance we would argue that this is a good thing, but from an Exter's pyramid perspective, it is obvious that a system limited to this type of lending would be unable to support and fund the upper layers of the pyramid.

To solve this issue, we need to find a viable solution that features uncollateralized lending as a financial primitive (building block). So far, these efforts have been explored by platforms such as Celcius and BlockFi, which came to market promising higher yields on crypto deposits. These yields were supposedly generated through DeFi activities, but over time it appeared these businesses were overly dependent on bull market returns through a prime brokerage-type of lending activity. This ultimately proved unsustainable, when market sentiment turned and many of the crypto "hedge funds" proved to be simply over-leveraged one-way bets.

There were three main problems here:

1) That the returns being promised to depositors were higher than those actually generated on the underlying lending book.

2) That the actual book was not appropriately risk managed.

3) That any meaningful credit event caused an immediate asset-liability mismatch.

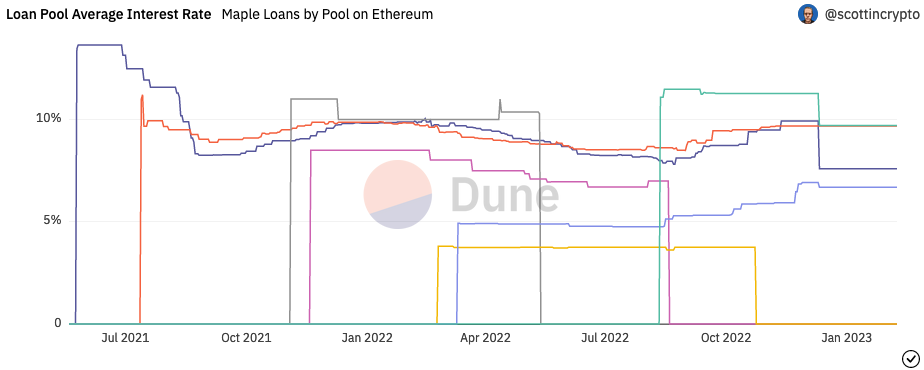

There was an inherently thin capitalization among many of these platforms, along with an opaqueness on who was actually bearing the credit risk. Maple Finance was notable in this context, as they boasted decentralization and on-chain provenance, but were lending largely to the same counterparties as the centralized prime-broking desks.

Notwithstanding the improved transparency and trailblazing attempt to decentralize credit creation, it too was unable to escape the effects on its borrowing base when the market turned. At least in Maple's case, it was clear that as a pool participant, where the credit risk fell, and from a protocol perspective it actually functioned as intended. The key takeaway here is that decentralization of credit creation was no cure for bad credit, concentration risk, or correlation risk with crypto market volatility.

Beyond pure over-collateralized on-chain borrowing, the problems described above are to a large extent explicable by the current stage of development of the DAE. Even today, it is not at all easy for crypto start-ups to gain access to FIAT payment rails, let alone make large directional payments for establishing a lending operation. Hence the underlying choice to limit lending activity to DAE participants was likely driven less by the attractiveness of the returns, and more by the practical necessity to bootstrap operations. That said, it is clear that this was not sustainable, and attempts will now have to be made to connect DeFi to real-world credit assets (RWA) going forward.

This can be done in many ways, which are all currently being experimented on within the DAE.

Although existing debt instruments are undeniably a better way to generate yield in the DAE than through prime brokerage, using digital assets to fund the FED through the tokenization of treasuries, is somewhat of an anathema to the ethos of crypto. This was very apparent from the heated debate in the Maker DAO, surrounding the incorporation of US treasuries, and other securitized debt instruments in their treasury and protocol. For now though, it appears that tokenization and inclusion of existing debt instruments will continue, and provide a safer basis for on-chain yield.

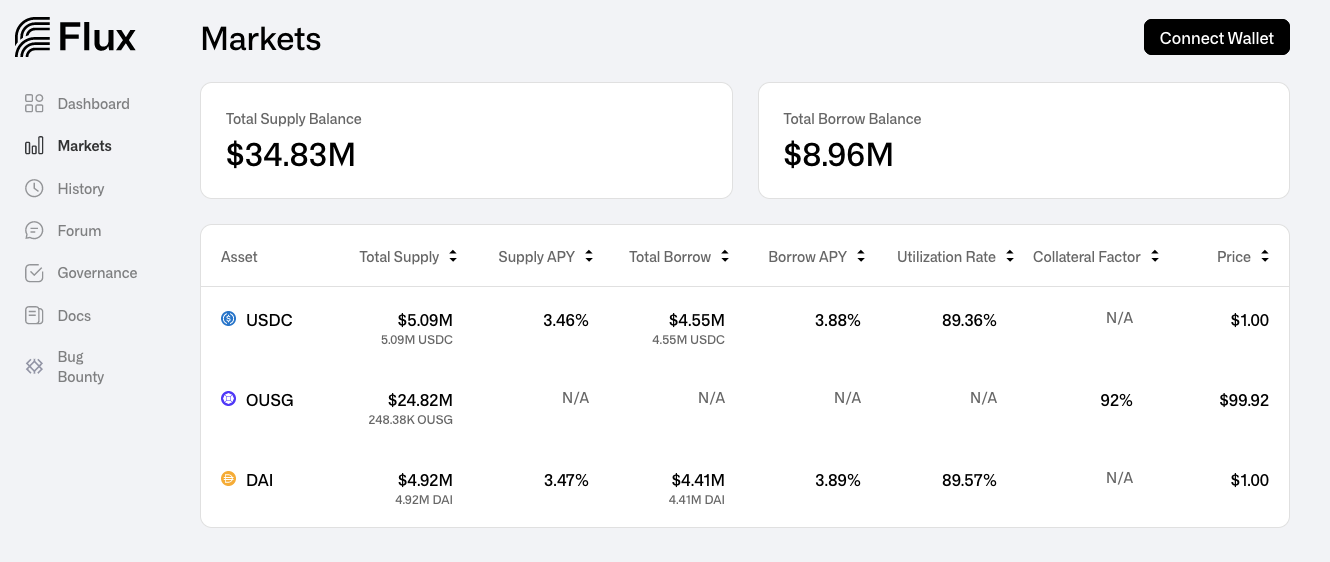

However, MakerDAO is not the only protocol taking advantage of the fruitful US Treasury yield, Ondo Finance recently launched into the space aiming to bring US Government Bond yield on-chain. As you would expect not anyone can just buy US Treasuries and the KYC procedure is rather strict meaning that the average degen cannot deposit at Ondo and start earning the juicy yields on their USDC. However, with the help of Flux Finance, this US Treasury yield is synthetically transferred to the broader DeFi market. Flux Finance gives the ability for Ondo users to borrow USDC and DAI against their tokenized US Treasury position and due to the relatively high yield these positions earn they can afford to pay a higher borrow rate and still be profitable. So what this effectively means is that the supply rate for USDC/DAI for the average user is much higher than the rest of the other lending markets in DeFi as the borrower can afford the higher rate, and now the DeFi market has access to synthetic US Government Bond interest rates.

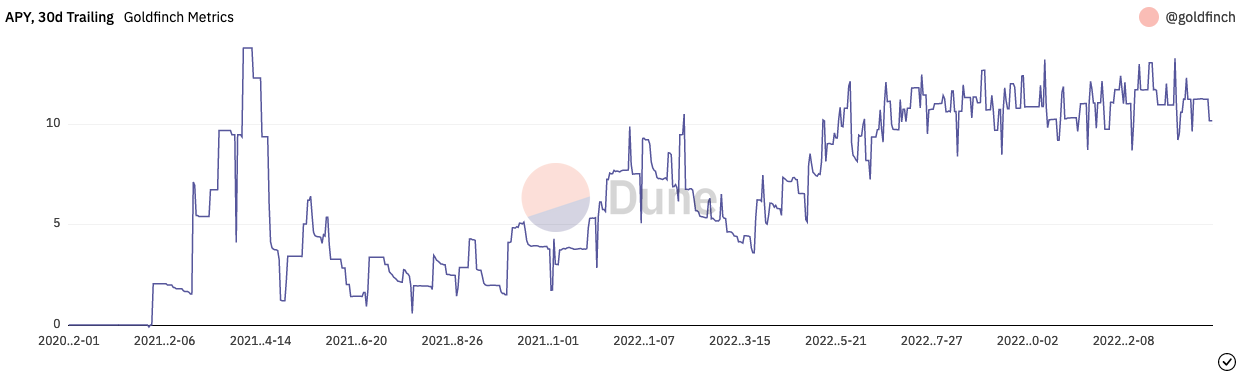

At Florence, we have crafted a unique value proposition within the newly forming DAE pyramid, by creating a composable and yielding asset, whilst also solving a real-world funding problem. We chose to focus on the SME market, but there are other protocols, that have ventured into other areas of the credit spectrum. They share a similar philosophy with us, in that they intend to use DeFi to improve the real-world credit creation process. This can be seen especially with companies like Goldfinch, who operate in areas neglected by TradFi, such as emerging market lending and microfinance.

We can see from the charts below, that Goldfinch has achieved relatively strong adoption, as its borrowing volume has only increased since inception. Its 30d trailing APY, has also become more steady with the progression of time. However, some charts like the one below show that some protocols have struggled to surpass their speculative boom in TVL and show less organic growth, which can be expected as the RWA space is still in such an early stage.

This is all to show that slowly but surely, the DAE is being connected to the real-world credit system. As that happens, we will be able to choose more easily how we use our digital assets to borrow or lend, and earn yield in an infinitely composable manner.

To date, the use of leverage and fractional reserves has been limited in on-chain lending. Most of the centralized parties that did employ leverage on their balance sheets have been put out of business, and no crypto player thus far has received a banking license allowing it to create credit in excess of its reserve base. One could argue that Tether came pretty close, before increased regulatory scrutiny, forced its hand to become more fully and transparently collateralized. Thus today, post CeFi lending flush, the leverage in the DeFi lending is practically zero.

The efficiency and transparency of on-chain lending, combined with the ability to self custody digital assets, make an ideal alternative to the fractionally reserved, centralized and increasingly untethered TradFi lending system. We believe that rehypothecation of digital assets through liquid staking type transactions/structures will enable people to earn a yield on digital assets whilst retaining their collateral use and that this could well be the single most important feature of DeFi. In time, we foresee that it will help to re-tether both lending and funding markets at large, as people express their preference for digital assets/loans over centralized deposits/loans in the legacy fractional reserve system.

There is still a lot that needs to fall into place for on-chain lending and DeFi, to be able to compete on merit with TradFi. At the outset, such innovation will likely happen in the areas least well served by TradFi like borrowing to crypto entities, EM lending, microfinance & SME lending. Without any head-on competition in these spaces, and as business models become proven and protocols more adopted, we anticipate a more inclusive, transparent, and tethered future of finance overall.